rhode island property tax rates 2020

65250 148350 CAUTION. 2020 Tax Rates.

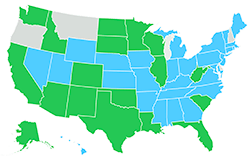

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

135 of home value.

. Ad Get In-Depth Property Tax Data In Minutes. Property tax rates also went up recently for homeowners in Johnston. One Capitol Hill Providence RI 02908.

Building Zoning. Many of my customers ask for the property tax rates in Rhode Island. After closing at 1601 for 2020 that rate climbed to 1642 the following year.

FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial Industrial Real Estate - 2810Personal Property - Tangible - 3746Motor Vehicles - The Motor Vehicle Tax has been eliminatedAll. For information about participating in PBNs Top Lists or to make additions or corrections call 401. Ad Enter Any Address Receive a Comprehensive Property Report.

FY 2022 Rhode Island Tax Rates by Class of Property Assessment Date December 31 2020 Tax Roll Year 2021 Represents tax rate per thousand dollars of assessed value. Tax amount varies by county. Request a Final Water Reading.

1300 per thousand of the assessed property value. That represents one of the larger increases for any municipality in Rhode Island. See Results in Minutes.

The states sales tax rate is 7 and there are no local sales taxes to raise that percentage. Fiscal Year 2021 Rhode Island Property Tax Rates. The credit is for dependents in tax year 2021 so babies born in 2022 wont be eligible.

Whether youre estate planning or working on another element of financial planning it can be a good idea to get professional help. The State of Rhode Island has eliminated the Motor Vehicle Tax for. Ranked by 2022 tax levies.

400 Reservoir Avenue Suite C Providence RI 02907. By law you are required to change your address with the Rhode Island DMV within 10 days of moving. Rhode Island has some of the highest property taxes in the US as the state carries an average effective rate of 153.

If so youll want to understand Rhode Islands property tax system so that you know what to expect on your first property tax bill. 2989 - two to five family residences. Tax assessments are set annually as of December 31st.

2020 tax bills are for active. East Providence City Hall 145 Taunton Ave. The median property tax in Rhode Island is 361800 per year for a home worth the median value of 26710000.

Motor Vehicles and Trailers 2288. All tax rates are expressed as dollars per 1000 of assessed value. The current tax rates and exemptions for real estate motor vehicle and tangible property.

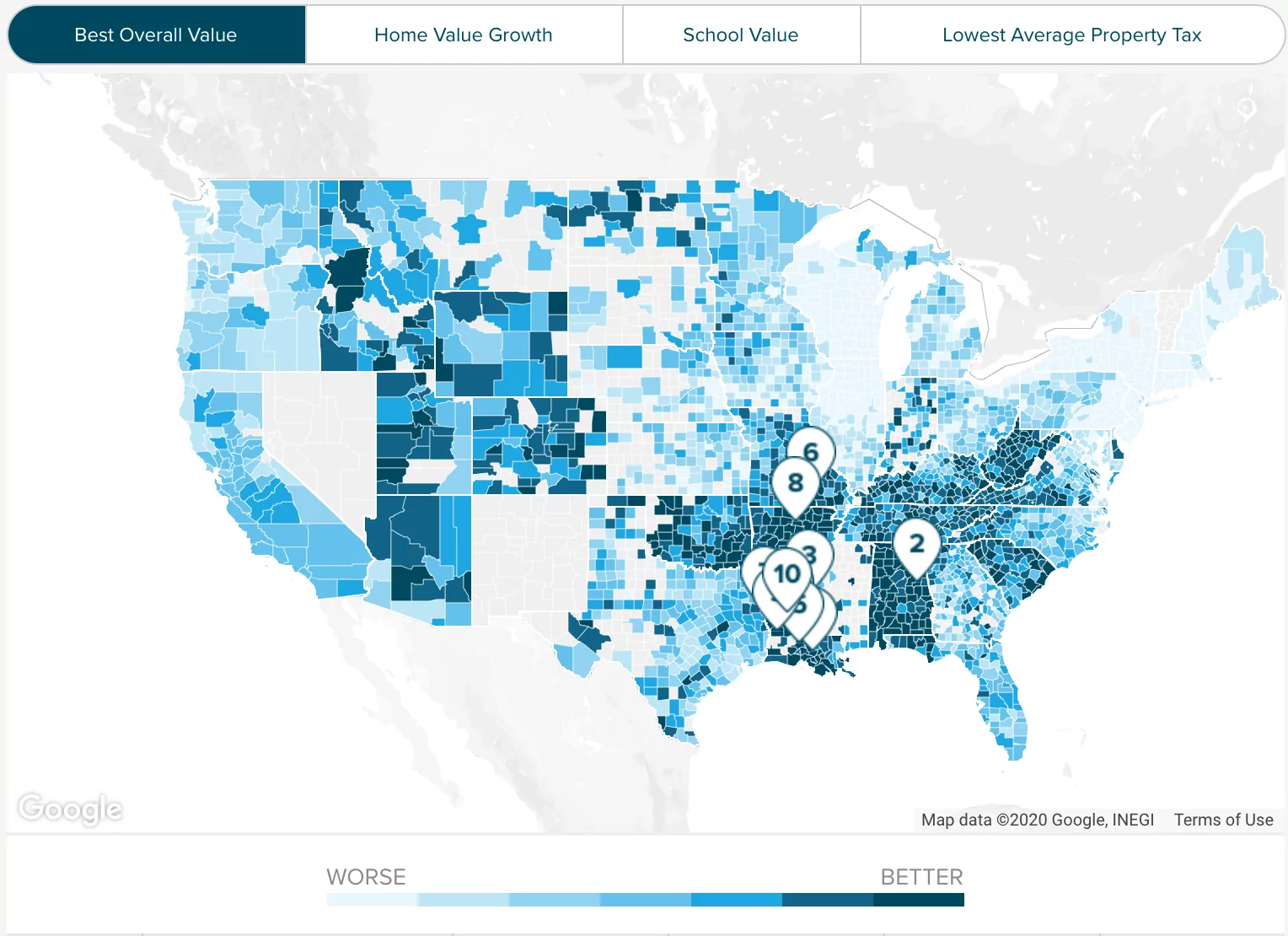

41 rows West Warwick taxes real property at four distinct rates. 39 rows 2020 Rhode Island Property Tax Rates on a Map - Compare Lowest and Highest RI Property Taxes. Rhode Island Property Tax Rates.

The project commenced in January 2019. The median property tax in Rhode Island is 361800 per year based on a median home value of 26710000 and a median effective property tax rate of 135. 3243 - commercial I and II industrial commind.

Such As Deeds Liens Property Tax More. Questions related to taxes and taxes due should be directed to the Finance OfficeTax Collections. 1300 per thousand of the assessed property value.

1 Rates support fiscal year 2020 for East Providence. Property tax rates for Johnston were 2289 in 2020. The credit will be available for single tax filers.

FY 2021 RI Property Tax Rates. 4 West Warwick - Real Property taxed at four different rates. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500 Town Exemption per vehicle.

It cannot be disregarded without staging a new complete assessment review. The Rhode Island Tax Rate Schedule is. You can look up your recent appraisal by filling out the form below.

A financial advisor can help. That comes in as the tenth highest rate in the country. RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 375 475 599 on excess 0 65250 148350.

Lets say four local similar properties sold for 1000000 recently but the disputed property with 100K in wind damage now has a 900K true worth. Data collectors always carry a letter of identification from the Assessors Office a photo ID badge and have their cars registered with the Police Department. File Your Return Make a Payment Check Your Refund Register for Taxes.

2 Municipality had a revaluation or statistical update effective 123119. Current Year Tax Rates 2021. 7 Rates rounded to two decimals 8 Denotes homestead exemption available 6 Motor vehicles in Portsmouth Richmond Scituate are assessed at.

Attached is a great reference by municipality. 39 rows Providence has the highest property tax rate in Rhode Island with a property tax rate. 3 West Greenwich - Vacant land taxed at 1696 per thousand of assessed value.

Assessment Division Resources. Tue 06142022 - 416pm. 3470 apartments with 6 units.

3470 - apartments with six or more units. Start Your Homeowner Search Today. Directed by State-licensed appraisers these reviews are nearly indisputable.

The average effective property tax rate in Rhode Island is 153 the 10th-highest in the country. By law you are required to physically return your plates to the Rhode Island DMV. Counties in Rhode Island collect an average of 135 of a propertys assesed fair.

The reassessment project will establish market value as of December 31st 2019 and will be reflected in the tax bills issued in the summer of 2020. Vacant land combination commercial structures on rented land commercial condo utilities and rails other vacant land. Administering RI state taxes and assisting taxpayers by fostering voluntary compliance through education and ensuring public confidence.

The current tax rates for the 2022 Tax Bills are. Search Valuable Data On A Property. 186867012 The complete list is available for purchase online.

Rhode Island Division of Taxation.

New York Property Tax Calculator 2020 Empire Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

Thinking About Moving These States Have The Lowest Property Taxes

Riverside County Ca Property Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

U S Property Taxes Comparing Residential And Commercial Rates Across States

2022 Property Taxes By State Report Propertyshark

Pin By Roxanne Hoover On Got To Go Florida Income Tax Tax Rate Moreno

Property Taxes By State County Lowest Property Taxes In The Us Mapped

How Do State And Local Sales Taxes Work Tax Policy Center

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Income Tax Rates Highest Lowest 2021 Changes

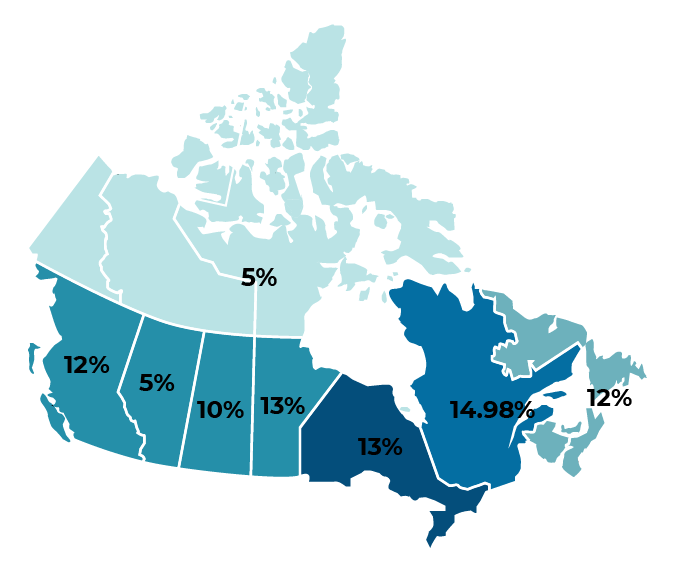

Which Province In Canada Has The Lowest Tax Rate Transferease