flow through entity taxation

We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow. The income of the owners of flow-through entities are taxed using the ordinary.

How Do I Pay Myself From My Llc Truic

01 April 2021.

. The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals. Pass-through entities typically include sole proprietorships partnerships limited.

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation. A flow-through entity is also called a pass-through entity.

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner. The Moment of Truth. In the end the purpose of flow-through entities is the.

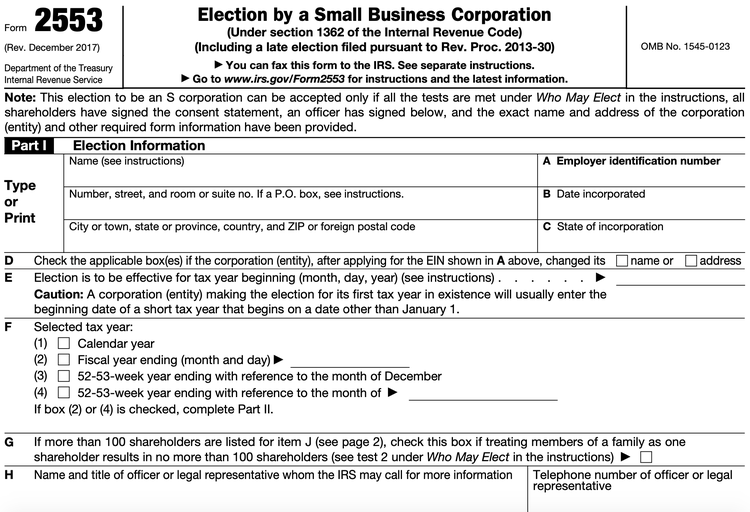

Have been modified to clarify the irrevocable three -year election for. Pass-through entities also called flow-through entities are business structures used by the vast majority 95 of US. Additionally the election instructions inSection IB.

Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. Recent Comprehensive Tax Reform Proposals. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships.

As well as links to websites and other resources of interest to the flow-through entities tax community. A flow-through entity FTE is a legal entity where income flows through to investors or owners. The majority of businesses are pass-through entities.

A flow-through pass-through entity is a legal business entity that passes all its income on to the owners or investors of the business. With flow-through entities the income is taxed only at the owners individual tax rate for ordinary income. The Michigan FTE tax.

A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests. Report of the National Commission on Fiscal Responsibility and Reform December 2010. The previous version erroneously named the due date of the annual return as the cutoff.

Proposals to Fix Americas Tax System Report of the Presidents Advisory Panel on Federal Tax Reform November 2005. Cash of 50000 Equipment with a FMV of 35000 and Carrying amount of 25000. Taxation Of Flow Through Entities Andrew contributed the following assets to a partnership in exchange for a 50 interest in the partnerships capital and profits.

Date by which flow-through entity tax payments will be eligible for the credit for a particular tax year. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. This means that the flow-through entity is responsible for the taxes and does not itself pay them.

Us Income taxes guide 117. However the late filing of 2021 FTE returns will be accepted as timely if filed within 6 months of the due date. Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate.

Common Types of Pass-Through Entities. You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Up to 10 cash back Example Question 3.

Companies to avoid double taxation. Allows a flow-through entity to elect to pay tax on certain income at the individual income tax rate. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

Every profit-making business other than a C corporation is a flow-through. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. Is elected and levied on the Michigan portion of the positive business income tax base of a flow-through entity.

Flow-through entities are used for several reasons including tax advantages. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. In these models the taxes pass or flow through directly to the owners rather than the company.

The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations. Simple Fair and Pro-Growth. Virtually all states recognize traditional general partnerships and limited partnerships as flow through entities for taxation purposes.

That is the income of the entity is treated as the income of the investors or owners. A flow-through entity is a legal business entity that passes income on to the owners andor investors of the businessFlow-through entities are a common device used to limit taxation by avoiding double taxationOnly the investors or. Follow the links below for more information on these topics.

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax. Because of the increasing use of such flow through entities for a variety of business issues at the state level continue to assume even greater prominence. Flow-through entities are considered to be pass-through entities.

Understanding What a Flow-Through Entity Is. This amount generally correlates to the business income attributed to members who will be taxed in Michigan. The income of the business entity is the same as the income of the owners or investors.

Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business and compare whether a flow-through partnership or S corporation S corp structure is still the right approach to meeting your business goals.

What Is A Pass Through Entity Definition Meaning Example

Sole Proprietorships And Flow Through Entities Ppt Download

Pass Through Entity Definition Examples Advantages Disadvantages

Jp Magson Private Client Wealth Management

A Beginner S Guide To Pass Through Entities

Pass Through Business Definition Taxedu Tax Foundation

Pass Through Entity Tax 101 Baker Tilly

What Is A Pass Through Entity Youtube

Elective Pass Through Entity Tax Wolters Kluwer

Hybrid Entities And Reverse Hybrid Entities International Tax Blog

What Are The Tax Implications For An Llc Effects Of Operating As An Llc

Pass Through Entity Definition Examples Advantages Disadvantages

Flow Through Entity Overview Types Advantages

Business Entity Comparison Harbor Compliance

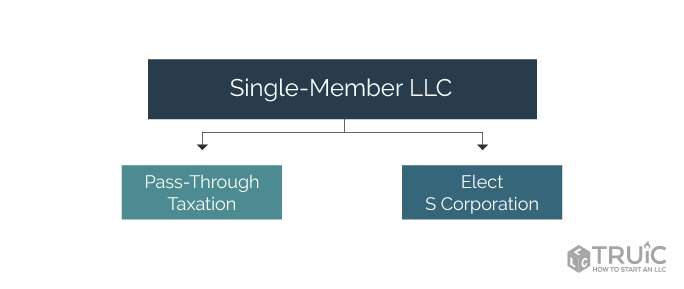

How To Choose Your Llc Tax Status Truic

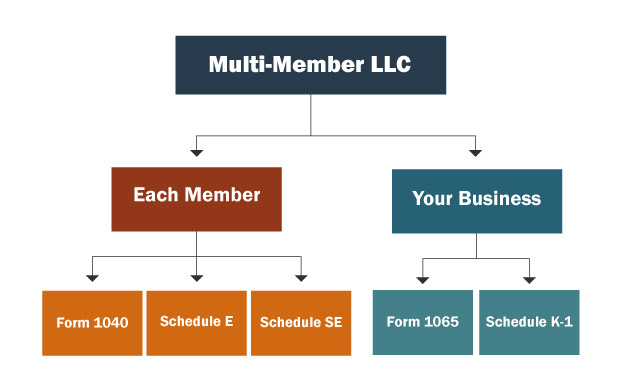

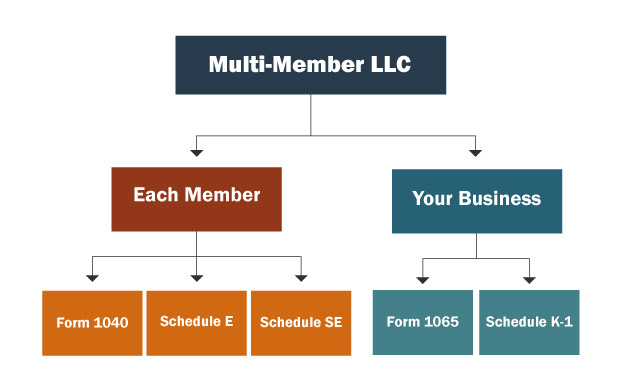

Multi Member Llc Taxes Llc Partnership Taxes

9 Facts About Pass Through Businesses

Pass Through Taxation What Small Business Owners Need To Know

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant